Real-time scoring platform enables digital transformation at DSK Bank

Real-time scoring platform enables digital transformation at DSK Bank

Real-time scoring platform enables digital transformation at DSK Bank

Business challenge

DSK Bank (part of OTP group) had outgrown its existing risk scoring engine. Deploying sophisticated models was time-consuming and error-prone, while a lack of infrastructure for proper testing increased operational risk

Transformation

DSK Bank is streamlining its model deployment process with IBM® SPSS® Modeler Gold—enabling models to move directly from development to testing and production without manual coding and with minimal IT support.

Business challenge story

Operating in an increasingly competitive market, DSK Bank recognizes that customer service is one of its most important differentiators. The bank is constantly working on innovative ways to serve its clients faster and more efficiently, and sees predictive analytics as a key tool to help it automate processes and tailor its services to the needs of each client.

One of the most important areas where DSK Bank uses predictive analytics is its consumer loans approval process. Consumer loans make up approximately 50 percent of the bank’s retail loan portfolio, and have complex approval and underwriting requirements.

In the past, due to the lack of an integrated automatic process and the many manual checks involved, customers applying for a loan often had to wait up to several hours to learn whether their request had been approved. DSK Bank realized that by accelerating the process, it could greatly improve the customer experience and gain a significant competitive advantage over other banks in the Bulgarian market.

The main issue with the existing system was deployment. The bank used IBM SPSS Modeler to design its models, but when a model was ready for production, the bank’s modeling team had to manually translate it into the input language used by the risk scoring system—essentially recoding the entire model from scratch. As the bank began using more sophisticated modeling techniques, this became increasingly time-consuming and error-prone.

Transformation story

Improving model lifecycle management

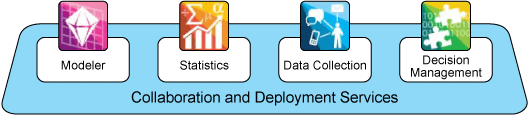

DSK Bank decided to solve its testing and deployment problems by extending its use of solutions from the IBM SPSS Modeler Gold portfolio, which includes IBM SPSS Collaboration and Deployment Services and IBM SPSS Analytical Decision Management.

“We have been using SPSS Modeler to design our models for more than 10 years now, and we’re very productive with it,” says Boris Ederov, Head of Customer Risk Evaluation Systems, DSK Bank. “We didn’t want to switch to a different platform that would be more difficult to use. Instead, we decided to replace the old scoring engine with SPSS Collaboration and Deployment Services and SPSS Analytical Decision Management.”

Working with IBS, a Bulgarian IBM Business Partner that specializes in helping clients achieve digital transformation, the bank delivered a successful pilot, which convinced the key stakeholders to migrate all existing models from the old engine to the new platform.

“The IBS team were very flexible and collaborative, which was vital because redesigning our consumer loans approval process was a real dive into the deep end. IBS helped us adapt the scope of the project to ensure we could deliver a new process that will meet all of our business goals.”

IBM SPSS Collaboration and Deployment Services provides a rigorous, standardized process for model implementation, enabling DSK Bank to enforce strict policies around the roles and processes involved in developing, testing and deploying models to production. Logging and security management is built into the platform, so it is easy for the bank to provide a complete history of the lifecycle of each model.

“With SPSS Collaboration and Deployment Services, the operational risks of moving a new model into production are almost non-existent,” says Boris Ederov. “We can be much more confident that everything has been properly tested and approved, and that our models are accurate and reliable.”

The solution also eliminates the need to rebuild models in a different language prior to deployment: the models move seamlessly from the development environment into testing and production, without requiring any recoding.

You can read the full case study at IBM public site.

Platforms used:

- IBM SPSS Modeler Gold

- IBM SPSS Collaboration and Deployment Services

- IBM SPPS Analytical Decision Management.

Contact us if you want to learn more about this solution.